Look at all your options before deciding if self-insurance is the right move for your business

No matter how much analysis they do, or how fit and healthy their workforce appears to be, many senior managers still feel unsure about what seems like a risky choice between being self-insured and fully insured.

On the one hand, employers appreciate that self-insurance cuts out premiums, may exempt them from state mandates and requirements, and potentially saves them 4 to 6 percent on taxes and assessments. They're also aware that if their health and well-being programs work and the population stays healthy, everyone's budget may benefit.

But on the other hand, they’re concerned by the unpredictability of claims-related costs.

Could level-funding be the answer?

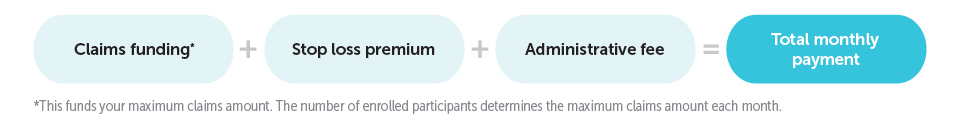

Level funding offers a clear middle ground: predictable costs and potential savings. It’s a straight-forward, off-the-shelf product that can be a good option for many small and medium-sized companies that want to move to self-insurance. Like a fully insured plan, it provides cash-flow certainty.

Predictable monthly payments make budgeting easier. Built-in stop-loss coverage protects against high-cost claims. Employers also benefit from regulatory advantages, including exemptions from some state mandates and fully insured premium taxes. And when claims come in low, employers may receive a refund at renewal.

What else to consider?

1. Keep the paperwork in mind

It’s important to remember that level funding is a form of self-insurance, so there are some administrative and compliance considerations of switching from a fully-insured arrangement. Teaming up with a carrier who has your best interests at heart makes managing your plan hassle-free with clear guidance, tools and real-time support from local teams. They help you:

- Set privacy boundaries within the company when handling employee health information

- Follow specific regulations and have access to legal resources

- Follow federal COBRA requirements

- Report Minimum Essential Coverage information to the IRS and policyholders

- Decide how much to charge employees for their coverage

- Calculate and pay the PCORI (Patient-Centered Outcomes Research Institute) fee

2. Reduce risk by helping your workforce be healthier

Employees who make smarter health decisions create better outcomes for themselves and reduce avoidable claims. Well-managed and thoughtfully-designed health and well-being programs can improve their health. Here are some things to consider that could have the biggest impact.

- Pinpoint the gaps in your workforce’s health and well-being. Health surveys, assessments and audits will give you a clearer picture of where the biggest health issues lie and which improvements might have the greatest impact. Review health plan utilization trends and audit your work environment. If multiple employees wear eyeglasses, you might offer comprehensive vision benefits. If a high percentage of employees indicate having diabetes, you might offer a diabetes management program.

- Take a holistic approach. It’s important to think about behavioral and environmental changes you could drive.

- For musculoskeletal issues, consider environmental changes like a standing workstation and behavioral changes like a strength training program.

- If you’re helping expectant mothers, you might offer a maternal health app that helps them stay on track during pregnancy and create a pumping room for moms who plan to pump at work.

- Addressing mental health? Consider adding meditation rooms and starting conversations to stop the stigma around mental health. (Make It OK from HealthPartners is a great resource.)

Reinforcing the benefit of using health and well-being programs and other value-added programs keeps employees healthier and helps businesses manage costs.