In today's fast-paced world – with a workforce that continues to face many stresses and an economy that is still finding its footing amid a lingering pandemic – employee health and financial bottom lines are interwoven.

But if you focus on managing high-cost claims and minimizing administration fees in the short term, you'll be locked in a cycle of reacting to costly risks rather than proactively addressing them. And adding a good Employee Assistance Program (EAP) is not enough.

Employers that thrive in today's market are investing and embracing long-term, people-centered workforce strategies that take a holistic approach to proactively supporting their employees' health and well-being.

Read on for guidelines about determining if your health solutions are contributing positively to the well-being of your workforce and bottom line or if they're falling short.

Focusing on high-cost claims isn’t enough

Our challenging economic environment makes focusing on high-cost claims seem like the right approach. But suppose you're only looking at claims for expensive care that has already happened to inform how you shape your workforce health strategy. In that case, you're overlooking key opportunities to prevent tomorrow's health care costs.

Adapting your strategy is less about altering it entirely and more about rethinking how you see your employees' needs and how your solutions support them.

When you zoom in on a single high-cost claim, it's easy to miss other needs and conditions that may go unsupported. In addition, this fragmented approach limits your ability to understand how to best manage the health of your entire workforce population.

To deal with workforce health effectively, look for solutions considering your employees' health care journey and every challenge experienced along the way. Organizations can proactively manage health care costs with personalized solutions that support everything – from staying healthy to a time of greatest need.

Flattening the risk curve helps prevent high-cost claims

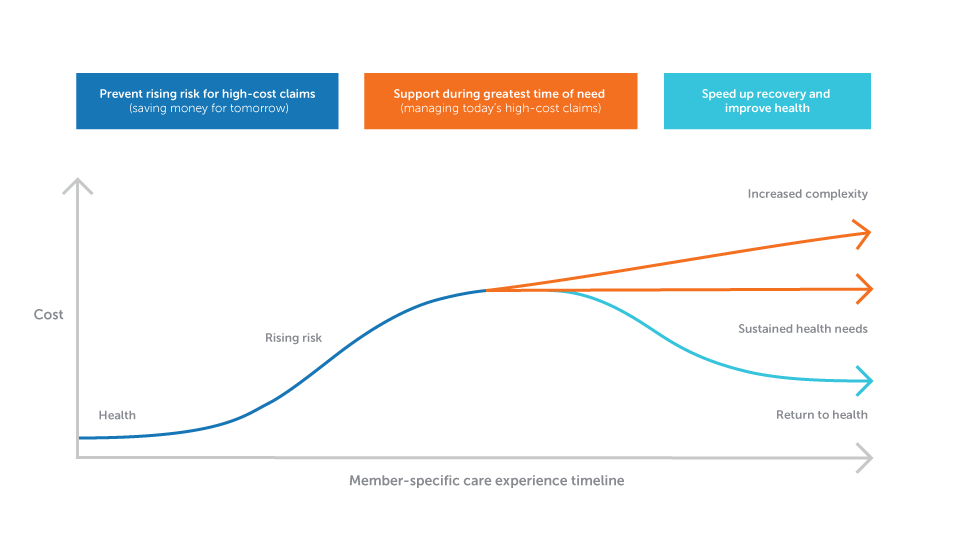

One way to visualize this journey is through the Care Experience Curve. It maps the continuum of health – from preventive, low risk health maintenance (which requires basic care needs) to the more complex (high-cost) management of serious health issues.

The goal is straightforward: Flatten and shorten the curve to prevent potential high-cost claims and efficiently manage current high-cost claims.

The right set of solutions will complement your traditional benefits (medical, dental and pharmacy) and support your employees as they navigate the Care Experience Curve:

How to flatten and shorten the curve:

- Provide solutions that encourage and support healthy choices (Preventing and delaying risk is key!)

- Lower the magnitude by ensuring your employees have health solutions they can easily access to support them in their time of greatest need

- Make sure you have supports in place to help accelerate your employees' return to health (e.g., shorter hospital stays, fewer re-admissions)

Here are three key questions to help you assess your current health benefit solutions to ensure they're doing just that:

- How inclusive and holistic is the support you offer to your employees?

- You may offer a variety of health benefits, but how connected are the teams and technology that work to support those various pieces of your plan?

- Does your carrier (or vendor) demonstrate accountability to your bottom line today…and tomorrow?

Download this assessment guide to help evaluate how comprehensive and connected your current health solutions are and whether they drive real, sustainable value for your organization.

Not all solutions are created equal

Although having a variety of solutions is essential – it isn't enough. For example, you might have an Employee Assistance Program (EAP), apps for mental health, or programs for specific conditions – all from different vendors.

But are they able to cater to your workforce along every stage of the Care Experience Curve? First, they must comprehensively connect the dots across various unique needs, conditions and care gaps to proactively identify, outreach and engage people at the appropriate time and place.

That means taking a hard look at population health – not just different interventions. Sophisticated population health metrics try to understand why one person had that heart attack, another broke their arm, another needs more care for their diabetes – and then use those insights to predict what will happen next time.

The goal is to address those contributing factors that can lead to a rising trend in claims costs. And often, the answers do not lie solely within health care, as it involves taking a holistic view of all possible risks beyond physical and mental well-being. It includes looking at social determinant metrics your workforce shares with us, like demographic, career, community, economic stability, food security, housing status, geographic location and relationship information.

Our HealthPartners Research Institute helps us evaluate the big picture regarding population health – going beyond symptoms and medical history to those social determinants and life satisfaction. Our research and technology teams use data to create cutting-edge predictive modeling software, which notifies our teams earlier if there are rising risks for an illness or condition. These alerts help guide the right interventions for your workforce, ensuring we can comprehensively meet all needs and concerns.

Seek out connected teams

It's not just technology and comprehensive solutions that drive proactive care, but teams working together to connect them all behind the scenes. Many health insurance vendors claim to offer integrated solutions, but how integrated are they? Numerous factors go into getting the right support to the right person at the right time.

Affordable, high-quality care starts with redesigning systems of care. It includes connected technology, clinical teams and administrative processes that create fluid relationships with your workforce. Be sure to examine how your employees engage with your solutions. Note whether teams readily share data and whether their incentives and goals are aligned.

As a care delivery system and a health insurance provider, HealthPartners understands that it takes more than a good set of solutions to manage care proactively. It's not about how many programs you offer, but whether you can create seamless links between them, so they meet each employee’s distinct needs.

Our teams collaborate to offer support before, during, after and between doctor visits. As a result, we ensure medication routines work, transitions from hospital to outpatient care are seamless, and referrals happen. Every effort emphasizes exceptional experience focusing on what each employee wants through motivational interviewing techniques and clinical decision-making skills.

Personalized outreach and shared data make a difference

Technology and teamwork also come together to design personalized, data-driven marketing strategies for communicating with your employees at various stages of their care experience. Whether they need preventive screenings, have diagnoses or chronic conditions – we work toward getting them the information in a way that fits them best. We employ a multifaceted approach that reaches out through each employee's preferred form of communication – such as phone, email or text message – so there is no doubt that they feel understood and cared for. In addition, all messages are tailored and meaningful to the recipient, ensuring relevancy, relatability and responsiveness.

And those lasting provider relationships with doctors and the care system in our networks help create a deep, interwoven understanding of your workforce's challenges. At HealthPartners, this relationship is made more accessible by sharing electronic health records (EHR) data. Our provider partners trust us to access and communicate within their IT systems rather than in separate silos. EHR access supports honest, real-time communication between our health plan and providers to align and understand care patterns and rising risks sooner. And this mutual trust we've built over many years means you don't have to wait for a claim to process – our teams across care and coverage come together to reach out at that critical time when a member needs it.

Find sustainable value

Managing your workforce's health can feel like a tug of war when showing real return on investment (ROI) or any sustainable value over time. The demanding economy and the pressures of rising costs can make it easy to focus on recent high-cost claims and health plans with lower administrative fees. However, while these strategies appear to save dollars in the short term, they can quickly increase costs over time if they don't include aligned teams working tightly together across the same technology and processes. And it's equally critical to look for a health solutions partner – not just a vendor – dedicated to improving population health and your bottom-line year-over-year.

Our deep provider relationships can also influence the Total Cost of Care (TCOC). Our TCOC framework, endorsed by the National Quality Forum, is the robust analytics tool we use to isolate pricing trends and variations in care. TCOC examines what causes costs to rise, enabling us to create a complete picture of all the factors involved. It gives us a powerful way to partner with providers to positively impact care – preventing unnecessary emergency department visits, hospitalization, inappropriate medication use, lab testing or consultations. Our goal is to highlight cost-saving opportunities and help them better evaluate their services without sacrificing high quality of care.

TCOC is the engine that drives how we form our networks and provider payment strategies that create more opportunities for you to offer your workforce affordable care at each stage in a member's journey without sacrificing care quality.

All these connected solutions come together to impact your bottom line well into the future. That's why IBM Watson found our total cost of care to be 10% lower in Minnesota and 7% lower in Iowa, North Dakota, South Dakota and Wisconsin. IBM Watson's benchmark comparisons also found that HealthPartners has fewer members reaching high-cost case thresholds and lower per-member-per-month (PMPM) spending among those who do. Plus, according to the National Quality Forum's Private insurance ratings, we're one of the top-rated health plans in Minnesota and one of the top-rated in the nation, with a 4.5 out of 5 rating.

By focusing on comprehensive and connected health solutions that offer sustainable value, you'll see a happier, more satisfied workforce that stays longer. This benefits you and your employees, including increasing productivity that helps bolster your bottom line. In addition, it shows you care about your employees' unique needs while also staying affordable – so they don't feel like you're sacrificing care quality to save money. You can have both – all it takes is having the right partner.

Ready to learn more about HealthPartners approach to proactive care and how we can help your organization and your employees thrive? Visit HealthPartners.com/ProactiveCare.