There’s lots of debate over which pharmacy benefits model best lowers costs. Do you integrate your medical and pharmacy benefits, often called a carve-in, or do you carve them out? It’s a question that’s worrying employers and their advisers as the financial risk associated with prescription drugs rises fast. Let’s look at carve-in vs. carve-out pharmacy benefits, the importance of transparency and how integration can help lower overall costs.

Carving in vs carving out: What it means

When it comes to managing your employees’ pharmacy benefits, you typically have two options to consider – carve-in or carve-out. But it can be difficult to understand what each approach entails and which will work best for your organization. Here’s what you need to know.

What does it mean to carve in pharmacy?

A pharmacy carve-in is when pharmacy benefits are folded in with your organization’s medical benefits. This integrated approach keeps everything together in one package that is coordinated by your primary medical health plan vendor. It includes data sharing for case management activities, member service functions and more. Your health plan provider will subcontract a pharmacy benefits manager (PBM) to help administer and manage your program, so you only need to manage one point of contact.

What does it mean to carve out pharmacy?

In turn, a pharmacy carve-out is when pharmacy benefits are separated from medical benefits and are managed outside of your organization’s primary medical health plan vendor. This approach is self-insured, and you work directly with a PBM to administer and manage pharmacy benefits. You have two or more contracts to manage, and many services are nonintegrated, meaning the employee has multiple places to call for multiple tasks. Those choosing this option are hoping to be able to have more negotiating power and greater control of their overall spend.

Deciding which plan to choose

Many brokers and consultants recommend carving out pharmacy benefits based on spreadsheet analysis, which is a common practice. But the data used to inform the financial analysis is limited and may not include details about formulary management or the total cost of care offered within the plan to a member.

In truth, an increasing number of industry experts believe there are many other, often better, opportunities to improve the value of pharmacy benefits. And none of them can be achieved effectively if pharmacy benefits are carved out.

In their view, just as you wouldn’t separate drug therapies from medical care, pharmacy and medical benefits should be tightly integrated too. And we agree.

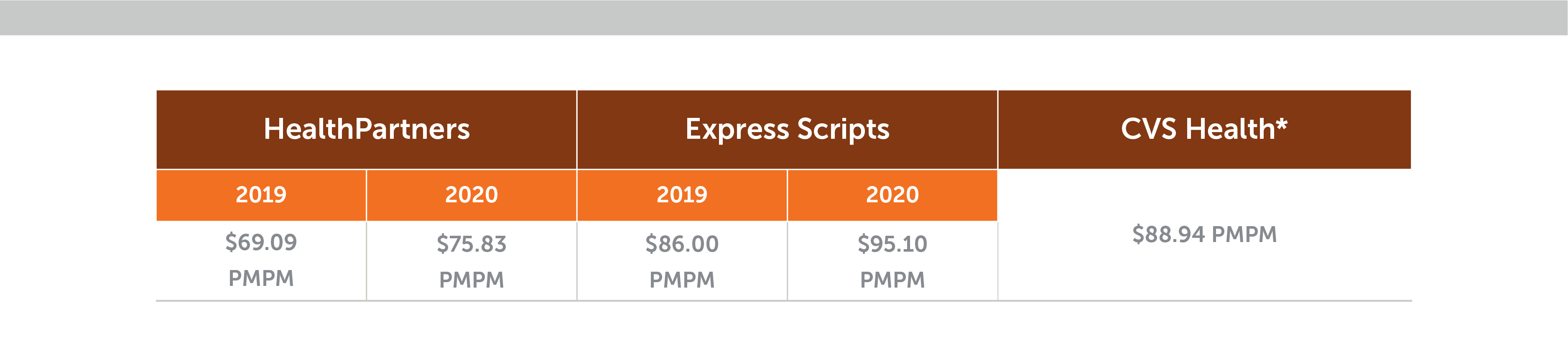

HealthPartners is a health solutions company providing care through hospitals and clinics, as well as insurance coverage for companies. Ours is a tightly integrated approach with our health plans managed in sync with the medical, pharmaceutical, dental and other care we provide. Matched with our commitment to reach the lowest net costs for members and customers, it brings employers uniquely powerful ways to manage prescription drug costs. Our consistently low pharmacy costs per member per month (PMPM) testify to it. The table below compares our performance with those of leading PBMs in recent years.

HealthPartners is a non-profit with the mission to improve affordability, patient outcomes and member experience. We’re proud of the clinical steps we take to ensure an employer’s benefits plan continuously improves health and well-being affordably. Here are some insights from our chief pharmacist, Dave Busch, about the advantages of an integrated approach to pharmacy and medical benefits, as well as best practices to ensure high value from your prescription drug plan.

Key benefits of carving in with a fully integrated pharmacy and medical benefit model

Employers usually cite three main advantages of carving in vs. carving out for their business, their members and their benefits team.

1. Administrative ease

In a carved-out arrangement, there are several contracts and vendors that need to be managed. It can be a lot to juggle. When pharmacy and medical plans are integrated, there just one point of contact.

Also, PBMs are masters of contractual loopholes. “PBM speak” is perpetuated by the industry and typically used in pharmacy benefit agreements. When your contracts are riddled with jargon, it’s easy to overlook opportunities for savings or miss pitfalls that can lead to significant financial risk.

At HealthPartners, we make things simple. You have a single, visible admin fee cost structure that covers all pharmacy-related costs for drugs prescribed on both the medical and the pharmacy side. You have a single account manager to help answer your coverage questions, and there’s only a single benefits contract to manage.

2. Lowest net cost prescription drug management

In this era of ultra-high-cost drugs, one of the most powerful ways to manage costs is to ensure that your benefits partner always uses the safest, most cost-effective drugs for your members. It’s important to find a partner who has skin in the game and consistently does this well.

For instance, HealthPartners carries all the risk of our large, fully insured business, where nearly all the plans we manage are integrated. Our in-house pharmacy team has deep, hard-earned clinical expertise that keeps our own prescription drug costs as low as possible while ensuring the most effective therapies for our members, whether under medical or pharmacy benefits.

All the programs and services we use to manage our fully insured business are also used to manage the risk and the costs of our self-insured clients.

We negotiate the lowest pricing in our network of retail pharmacies, mail order pharmacy and specialty pharmacy partnerships. And we pass on all rebates to customers.

3. Excellent member experience

It’s hard to lower your pharmacy costs if your members aren’t getting adequate support to follow their therapies correctly and start feeling better. Taking multiple medications when you’re depressed and struggling with various medical conditions at the same time is tough. It’s the type of situation where things go wrong, medications get mixed up, therapies are abandoned and people end up in the emergency room. Members often need help to adhere to their therapy regimens, and they appreciate it when they get it.

An integrated approach allows behind-the-scenes collaboration and data sharing between clinical, pharmacy and health plan experts. Things work smoothly in a way that members often feel. It makes a big difference for members. But when a member’s experience is simple and positive, it can also make a big difference for your HR team.

At HealthPartners, we make sure to surround our members with tools like an easy-to-use app that helps them manage all the details related to their care and their plan in one place. For example, members can compare drug prices at pharmacies or find a network provider. It’s tools like our app that help us consistently get top ratings in member surveys.

Why should employers care about transparency in pharmacy benefits?

Employers need to be on the alert. When it comes to keeping your costs down, the transparency of your business arrangement and integrity of your partners are just as important as the infrastructure and expertise supporting you across your benefits. Far from providing a low-cost option, some PBMs are notorious for exploiting loopholes in deliberately opaque contracts, slipping in undisclosed markups and pocketing lucrative savings that are earned on the back of the employer’s benefit.

To protect themselves, state employers and other well-informed business organizations now insist on transparent contracts with clear fees and tight definitions.

So it’s key to find a pharmacy partner, whether a PBM or a health insurance company, that will agree to transparency. At HealthPartners, we base our entire pharmacy business on this. Our single administration fee covers all our operating costs plus margin. It’s fully disclosed. That’s where we make our living, and we do it transparently.

The most impactful ways to maintain overall lower costs

Below are some of the most impactful ways we see our clinical expertise improving affordability when medical and pharmacy benefits are integrated.

Higher generic use

Several industry reports, including one from the Kaiser Family Foundation, have found that prices for the most popular brand-name drugs covered by Medicare Part D grew significantly faster than the rate of inflation over the last decade. Price growth for brand-name drugs is drastically higher than for generic drugs. However, brand-name drugs almost always have lower-cost, equally effective generic equivalents. Systematically encouraging members to request and providers to opt for cost-effective generics is one of the best ways to achieve savings across the board.

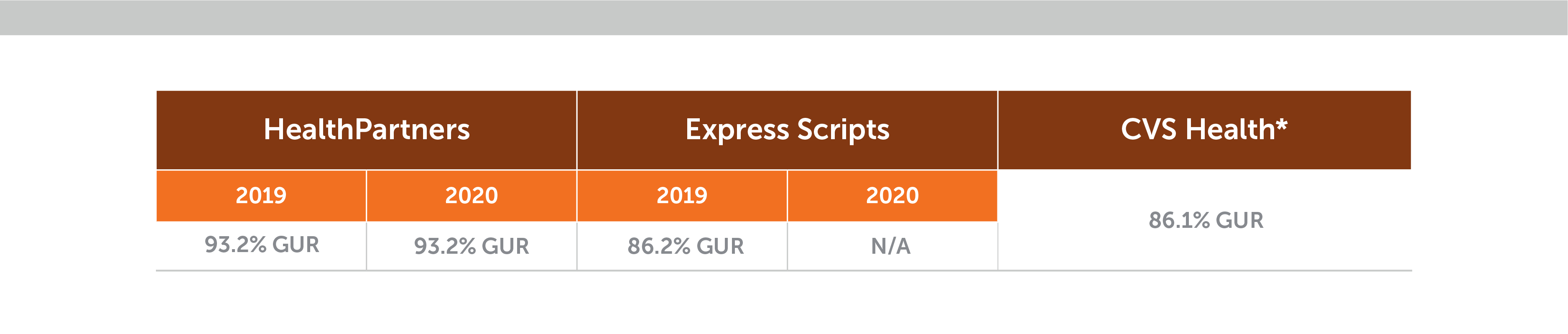

Here’s what we see with employers that have our integrated plans. For each 1% increase in generic drug use, overall pharmacy PMPM costs go down by 5%. We often achieve savings in the range of $2.10 to $3.15 PMPM. The table below shows our high generic use rate (GUR) compared with other leading PBMs.

Clinical specialty programs to help manage high-cost cases

Clinical review pharmacists can intervene to lower costs on high-cost pharmacy cases. We monitor the drug pipeline to predict and plan for new and lower-cost drug options like generics and biosimilars. Biosimilars are often good alternatives to expensive, bio-engineered “biologic” drugs because they are structurally “highly similar” and have no meaningful clinical differences. And we’re constantly working to find the most cost-effective, convenient sites of care for our members – for example, lower-cost, more-accessible clinics instead of expensive hospital outpatient facilities.

Here are some ways we’ve innovated to drive big savings:

- Cheaper biologics. We require our specialty pharmacy partner to use a maximum allowable cost list just like retail pharmacies do. This results is savings of 80% off the list price of generic biologics rather than discounts of 55-60%.

- Alternative biosimilars. As biosimilars become available, we compare the cost of each one against that of the reference brand, choosing the agent that is the lowest net cost. And we include providers in the decision to facilitate therapy changes. This was demonstrated when we achieved a 90% market share for the biosimilar Inflectra (over Remicade) the first month after we preferred it.

- Finding the best site of care for medical injectables and infusions. Using more convenient and cost-effective sites of care for patients receiving medical injectables can deliver high savings. We do this proactively. Our programs have won awards and regularly result in annual savings of around $20,000 to $50,000 per impacted member.

These are just a few of the many ways we strive to keep costs down for our members. And we closely monitor performance of all our programs to ensure savings are on track.

We hope we’ve given you plenty of reasons to consider an integrated pharmacy and medical benefit model versus carving out for reaching the lowest net cost. We believe our approach with pharmacy as an integral part of all our clinical work to improve health and well-being is the most effective route. Our market-leading results are proof.

Want to learn more about the key elements we apply to help driving real savings?

Download this pharmacy benefits performance grid

To discuss integrated benefits with HealthPartners, call 952 883 5200 (or toll free on 1-800 298 4235) or contact us at pharmacybenefitfacts@healthpartners.com.

Ask your adviser about these issues and see what data they can provide to ensure you have a good comparison of all costs under our integrated approach.