The mere mention of pharmacy benefits can make employers anxious. There’s a lot of confusion about why drug costs are rising so fast, and whether pharmacy benefit managers (PBMs) are doing a good job at managing those costs and providing the value they should.

We want to help business leaders like you understand the context and gain visibility into what’s going on behind the scenes within the pharmacy benefit industry. Ultimately, this insight can help ensure your company and your employees are getting the greatest value from your pharmacy benefits plan.

Understanding pharmacy benefit management and drug pricing

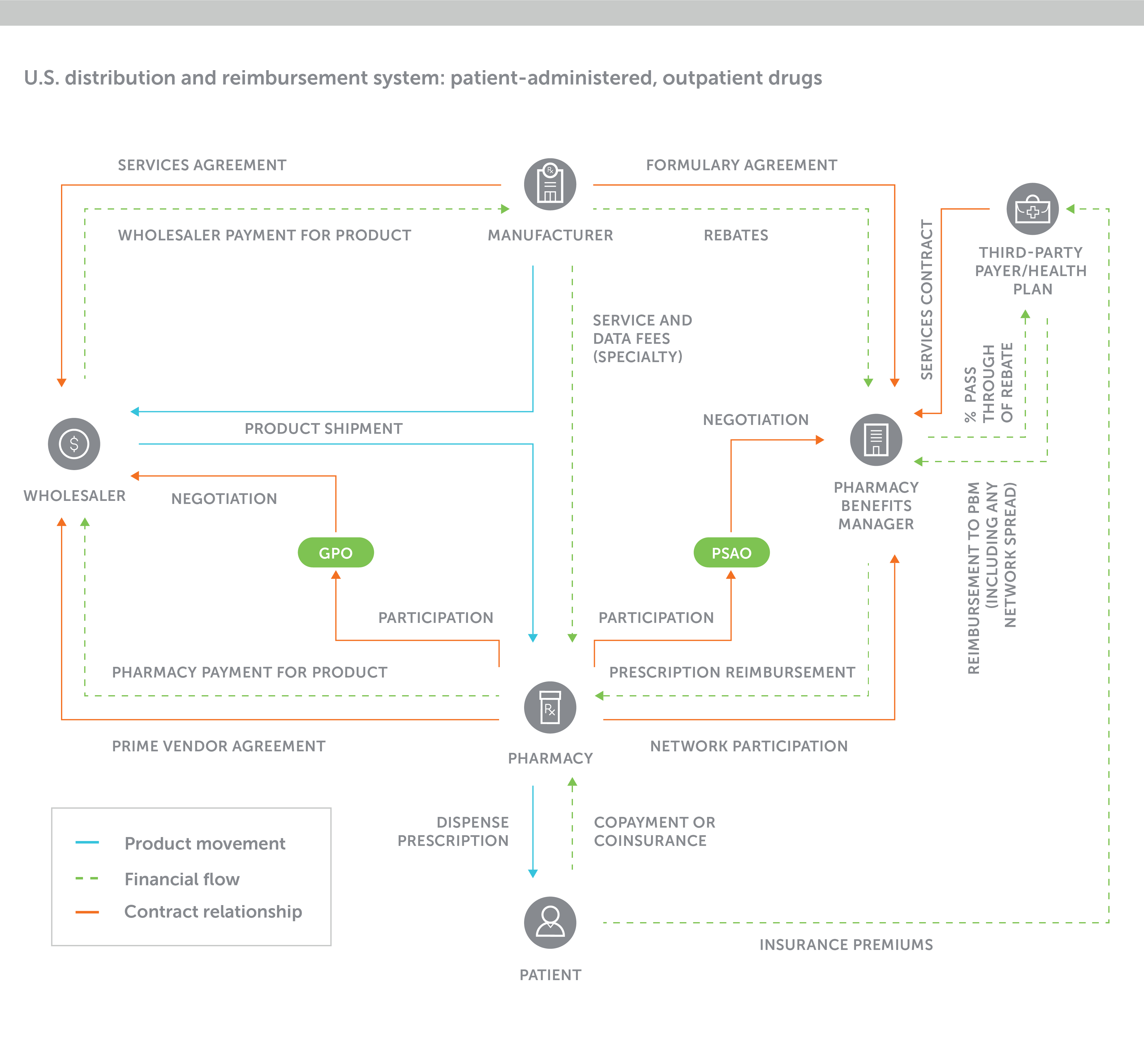

The U.S. prescription drug supply chain is extraordinarily complex. To better understand it, see the below diagram. It captures, with strong simplification, the web of stakeholders in the prescription drug market and the myriad of contractual agreements that drives the cash flows between them.

How does a pharmacy benefit manager work?

What is a pharmacy benefit manager (or PBM)? A PBM is a third-party administrator of prescription drug programs for a range of plan types. They can play a significant role in the cost of prescription drugs for employers and their employees.

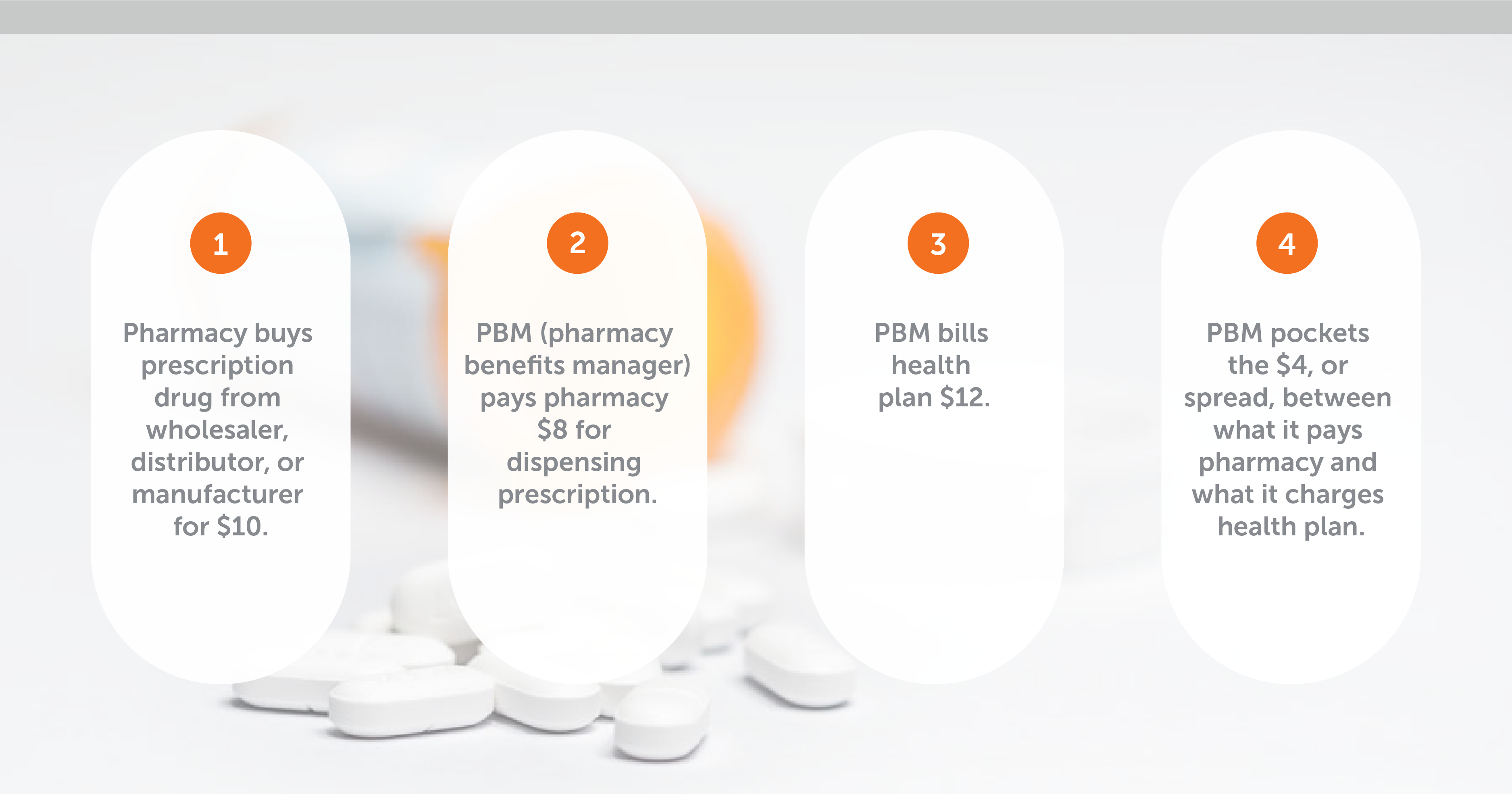

To help you come to grips with it quickly, here’s what employers need to know about pharmacy benefit managers and cash flow.

PBMs play a central and powerful role

The pharmacy benefit manager sits in a prime position in the middle of this complex system. They connect key stakeholders, managing negotiations in all directions, and provide the technology and expertise to support clients’ pharmacy benefits.

Specifically, PBMs help to:

- Manage the purchasing, reimbursement and dispensing of prescription drugs for employers or health plans

- Create and maintain pharmacy networks (mainly retail, mail and specialty) where members can access their medications

- Create prescription drug formularies (lists of drugs preferred by the benefits plan) that influence what physicians prescribe

- Provide clinical and disease management programs to encourage correct usage and adherence

- Negotiate prescription drug pricing

- Operate or contract with a mail-order pharmacy

Large, traditional PBMs have a deep understanding of the market, technological mastery, a grasp of potential loopholes, and possess highly concentrated negotiating power. They leverage the system to their advantage. And that often means they choose not to tell employers about lucrative pricing and transactional details related to contracts with other stakeholders throughout the supply chain. That in turn means increased costs and missed savings for employers.

How do PMBs make money?

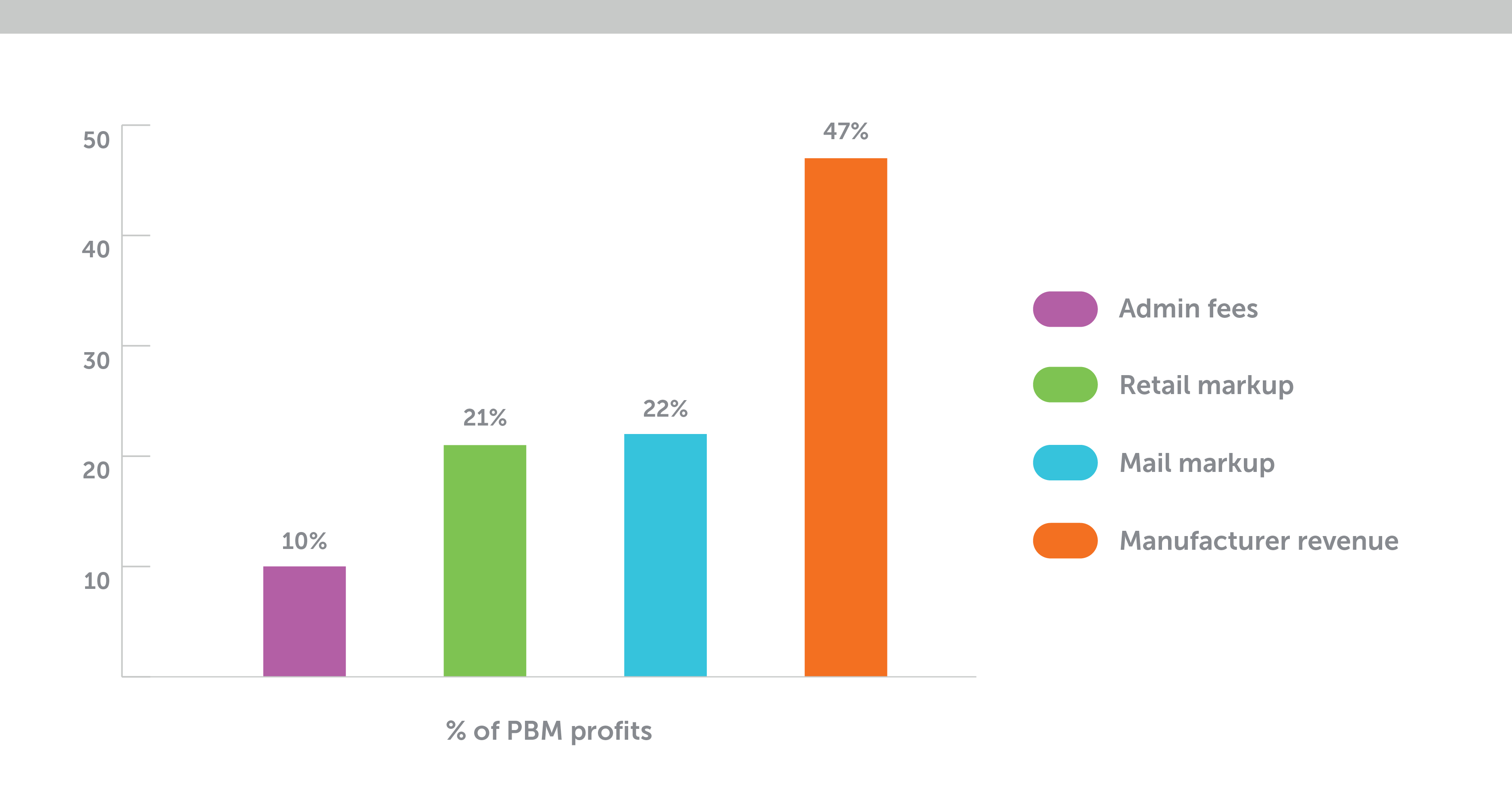

PBMs have a wide range of revenue stream opportunities that may or may not be used in every customer case. Traditional PBMs earn administrative fees for services provided to the employer. They also operate a “reseller” business model, earning margin on prescription drug fills at retail and mail-order pharmacies.

They may keep or pass through a percentage of prescription drug rebates paid by pharmaceutical companies in return for placing their drugs on the plan’s formulary (list of preferred drugs). This portion of margin is most often disclosed to the employer.

Other drug sales-related incentive payments from drug manufacturers to the PBM may not be disclosed or passed through. For the purposes of this article, all payments to the PBM from the drug manufacturer, whether disclosed or hidden, are described as “manufacturer revenues.”

PBMs make money through the following streams:

Administrative fees – Transparent fees from the employer to the PBM for clearly delineated services such as claims processing paid per transaction.

Spread pricing – Often not disclosed to the employer, these are markups on ingredient costs at retail or mail order. Or stated differently, a PBM might charge an employer a higher price than they reimbursed the pharmacy.

Spread pricing, which is usually applied to all generic and some brand drugs, can prevent employers from achieving lowest net cost on their drug spending. The dollar values of those markups can routinely be $6 to $8 (or even more) per prescription. For a medium-sized company, this can amount to hundreds of thousands of dollars spent over the actual cost of the drugs.

Manufacturer revenues and rebates – Employers often mistakenly assume that their “rebate” includes all the plan-related revenues paid by the drug manufacturer to the PBM.

On the contrary, a range of manufacturer revenues might be earned by the PBM without being disclosed or covered in the employer’s contract with the PBM. There are two points to be aware of when it comes to rebates and other manufacturer revenues.

- High prescription drug rebate guarantees need to be examined with caution – To achieve them, the PBM may be favoring higher-cost brand name drugs to meet manufacturers’ rebate requirements. Rebates are only paid on high-cost brand drugs – often those we see advertised on TV. Prioritizing these drugs can be a costly mistake when much cheaper, equally effective generic drugs exist because the overall cost of the more expensive drug far outweighs the size of the rebate.

- Other, undisclosed manufacturer revenues (often accounted for as fees) may not be aligned with the employer’s interests – Not only do these fees drive potentially wasteful volumes of high-cost drugs, but they also represent earnings that are not passed through to an employer, despite being generated thanks to their benefit plan.

Identifying pharmacy benefit plan red flags

Unusually low administrative fees and high formulary rebates should be a red flag, signaling that the PBM may be making most of its money through spread pricing (markups in this diagram) and potentially undisclosed manufacturer revenues.

According to researchers: “Services with the potential to increase revenue streams to the PBM may lower administrative fees ... Plan sponsors have made unfavorable and often uninformed trade-offs for reduced administrative fees to PBM.”

Prescription drug pricing trends and pharmacy benefit management

Pharmacy benefits are the most frequently used aspect of health care for Americans. In fact, according to a report from Express Scripts, nearly 19 prescriptions per person were dispensed in 2019 – and more than three-quarters of those prescriptions were dispensed to people with chronic conditions.

We’re approaching a perfect storm of new high-cost drugs, rising chronic disease levels, frequent medication use and rapidly increasing prices for brand name medications. The result? Americans’ overall spending on prescription drugs grew to $335 billion in 2018 and is projected to reach $511.1 billion by 2025.

That’s bad news for businesses. The self-funded employer’s No. 1 concern in the health care area is now the fast-escalating financial risk associated with prescription drugs. Imagine a self-insured employer with 1,000 employees – a few unexpected million-dollar pharmacy claims could take them to the brink.

Simply put, many employers are feeling this disadvantage. They’re realizing that lack of insight has put them in a weaker position in comparison to more in-the-know stakeholders within the supply chain.

Specialty drugs: A key driver of prescription drug costs

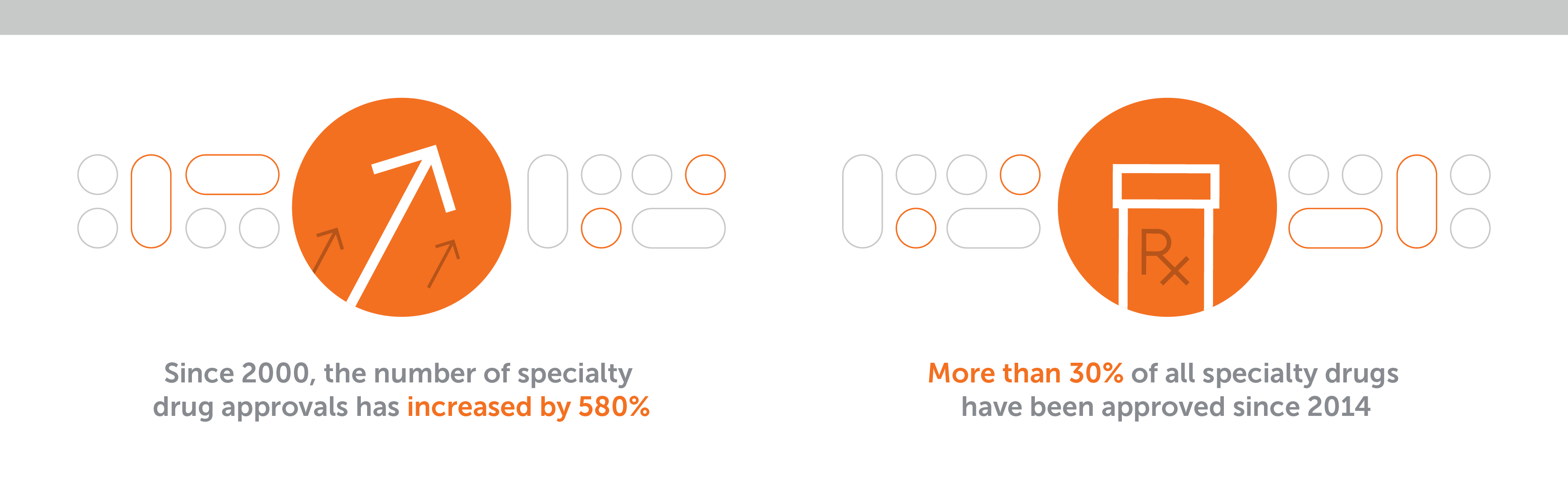

Key drivers of this growing expenditure are increasingly expensive brand and specialty drugs. Specialty drugs are the high-priced category of medications for rare or chronic diseases. They're usually of biological origin, and they require medical oversight, patient support, and expert handling and administration of the drug.

“Drug benefit management now equals specialty benefit management.”

Spending related to specialty drugs is now often more than 50% of the total pharmaceutical cost for a given employee population. According to the Pharmacy Benefit Management Institute’s (PBMI) 2019 Trends in Specialty Drug Benefits report, for many employers, drug benefit management now equals specialty benefit management. The illustrations below show why.

Seeking new ways to manage prescription drug costs

The financial risks associated with specialty and high-cost brand drugs are significant and growing. As major purchasers of prescription drugs for their public employee drug plans, many state organizations are urgently introducing ways to mitigate the risk.

Commercial employers are further behind. Without another road map to follow, most still try to solve the problem by going out to bid. They apply the familiar spreadsheet approach with their broker or consultant, hoping to find a supplier with lower administrative fees and higher rebates.

But others, like the Midwest Business Group on Health (a coalition of 130 employers), have recognized a need to improve their understanding of the whole process. They're signing up for training and asking questions about the journey of prescription drugs from pharmaceutical manufacturers to their employees’ medicine cabinets. And they’re wondering: What’s happening along the way to make it all so expensive? How can this be better managed?

Conclusion: PBM alternatives and the value of transparency

Few employers have the capacity or tenacity to develop the expert market knowledge of an experienced pharmacy benefit manager. But it pays to understand that there are alternatives to the traditional PBM model, which can lack transparency and be stuffed with potentially misaligned incentives.

Employers should know that there are many things they can do to take control of how their pharmacy benefit is managed – in the best case, negotiating unrestricted visibility to all manufacturer revenues, and drug pricing based on true costs plus a fair fee for services.

As one employer in the MBGH employer coalition urged: “Don’t sign a contract until you know where every single penny is going.”

The easiest route to a pharmacy benefit that both improves health and is managed to the lowest net cost is to work with a partner whose business model is based on integrity and full transparency.