Are prescription drug rebates a good thing for employers or not?

Let’s start simple: What is a prescription drug rebate?

Rebates are payments from drug manufacturers to pharmacy benefit managers (PBMs) in relation to prescription drugs dispensed to plan members. According to a 2019 Pharmacy Benefit Management Institute (PBMI) report on specialty drug benefits, 88% of employers currently receive some of these rebates from their PBM as part of their pharmacy benefit contracts.

However, while many employers appreciate this boost to their cash flow, 50% of survey participants expressed at least some interest in the idea of an alternative to the rebate-driven approach. But why?

Drug rebates 101: The PBM and pharmacy relationship

Prescription drug rebates are usually paid on the most expensive drugs (brand and specialty) – for instance, drugs like Humira, which is taken by adults with moderate or severe rheumatoid arthritis, that are advertised often on TV.

Drug rebate payments frequently serve as a tool of negotiation to promote the use of expensive brand drugs. Manufacturers get a prominent placement on payers' drug lists to increase market share, and in turn, PBMs and health plans receive a lower cost for the brand drug. But the real opportunity for savings is missed, because an even lower cost generic equivalent is often available.

Why do drug manufacturers offer rebates to PBMs?

Many employers are not aware that, apart from the formulary rebates (most of which are passed through to them), PBMs may also be receiving other financial incentives from drug manufacturers (sometimes known as manufacturer revenues) related to the volume and price of drugs dispensed through the pharmacy benefit plan.

To keep these payments for themselves and avoid having to pass them through to the employer, some traditional PBMs keep them under the radar. They may reclassify them as something else such as admin fees, market share fees, clinical program fees or data management fees. These “fees,” pocketed by traditional PBMs, are commonly 10 times larger than the formulary rebates employers receive.

According to Pew Charitable Trust, between 2014 and 2016, PBMs more than doubled the income they earned from spread pricing (markups on drugs) and fees from drug manufacturers.

Where do drug rebates go?

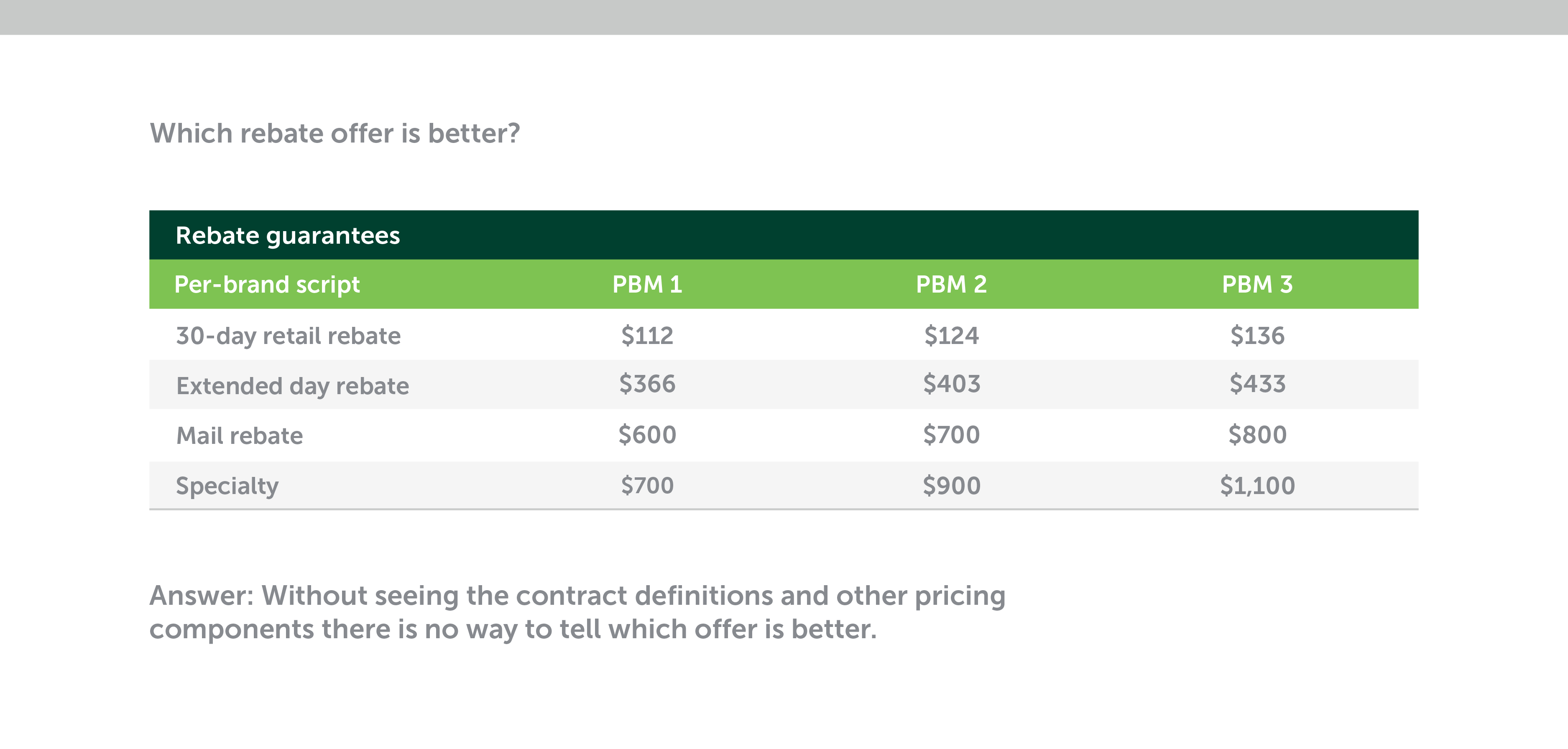

There’s a lot of room for loopholes in pharmacy benefit contracts, particularly those from traditional PBMs. Without knowing the details about the terms or pricing components, it’s impossible to make side-by-side plan comparisons. The lack of detail creates blind spots, which prevent an employer from easily identifying a plan that’s in their best interest.

Digging deeper, it is important to understand that rebates can distort in a way that may look beneficial on the surface, but in truth, can be quite detrimental. This story illustrates how it can happen:

One PBM was so motivated by the lucrative rebate on a multimillion-dollar specialty drug that they overrode a loosely managed prior authorization step (where a high-cost drug must be medically justified by a clinician before it can be dispensed). This step, if properly implemented, would have prioritized the use of a less costly, but equally effective generic drug.

By allowing the high-cost drug to be dispensed, the PBM generated a rebate worth tens of thousands of dollars. However, the same rebate also drives the price of prescription drugs up, which ends up costing the employer millions of dollars without them even knowing. This added cost could have been prevented had a formulary (a list of preferred drugs) and prior authorization step been set up robustly to favor an effective, lower-cost generic drug.

It’s important for employers to understand how and why costly things like this happen and what to do to avoid them – especially when deciding how to design the right pharmacy benefit plan, negotiate a PBM contract and evaluate plan performance.

Drug rebates can distort true drug pricing

A small but growing number of employers see rebates as a pricing distortion. In the 2019 Pharmacy Benefit Management Institute (PBMI) report, one respondent commented that rebates “make it more difficult to understand what a medication actually costs the plan.”

In the same report, another small employer urged employers to stop pursuing rebates as a cost-lowering strategy, and instead focus more on “pursuing a lowest net cost strategy.” A third called for a “100% pass through model.”

Where do you stand on the issue? With your pharmacy benefit plan in hand, how would you answer the question below?

Chasing rebates can raise costs overall

Common conditions set by drug manufacturers to earn rebates and other “fees” include:

- Increased market share – Rebates can encourage the use of more medications and may be wasteful.

- Preferred status on the formulary – This usually is done with a lower member copay than for other equally effective rival products, so the employer bears more of the cost of these already high-cost drugs.

- Clinical programs – This tactic encourages doctors to prescribe certain drugs. The more prescriptions that are filled, the higher the drug sales and larger the rebate size for PBMs.

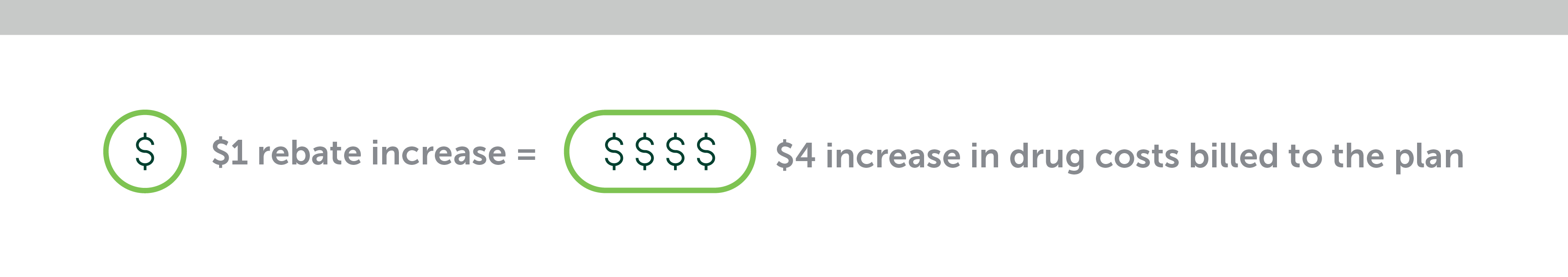

The downside of this approach for the employer is captured by a simple formula:

Employers need to ask themselves whether they are spending more on higher-priced drugs to get more in rebates.

Conclusion: Start asking questions about prescription drug rebates

Employers can find out whether rebate chasing is raising their costs by asking questions to understand where and how the PBM earns most of their revenues connected with the plan. Here are some thought-provoking questions to start the process.

- Is the PBM driving to lowest net cost or big rebates? PBMs may guarantee prescription drug rebates. That means your benefit design must generate a certain volume of high-cost brand or specialty drugs. When high-cost drugs create big earnings, how motivated is your PBM to manage the formulary to lowest net cost? Dig deeper:

- Are they incentivizing members financially to use more cost-effective generic drugs instead of brand drugs?

- Do they mandate generic drugs?

- What is their generic dispensing rate?

- Do they use gatekeeping tactics such as step therapy (where a more cost-effective drug is always tried first) or prior authorization before allowing higher-cost drugs?

- Are clinical programs driven by science or profit? Are there any ulterior motives behind some of their educational programs? While educational support for patients and providers can be extremely helpful, it’s also possible that these programs are designed to drive higher use of more lucrative, higher-cost drugs. Ask, in detail, what their educational programs offer.

- Is the plan being managed to encourage or eliminate wasteful drugs? When medication volume is incentivized by the drug manufacturer, how motivated will the PBM be to stop wasteful use of drugs? Do they have programs to ensure prescriptions are not refilled too soon, or medications packaged in excessively large volumes, as sometimes happens with mail-order pharmacies?