Medical insurance plans in Minnesota, made for you

Don’t get health insurance through your job? Working for yourself? Retired early? No matter your situation, HealthPartners has options that fit what you need. Enjoy affordable plans full of benefits and perks, comprehensive coverage, and access to all major care systems in your area – with doctors you know and trust.

Keep your current doctors with networks designed around high-quality care at affordable costs.

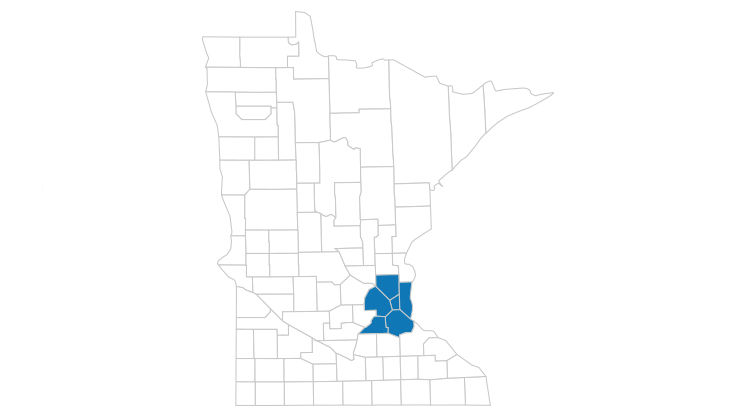

The Select ACO network

The Select network is a great choice for people in the Twin Cities area looking for a focused, lower-cost network. It includes:

- HealthPartners and Park Nicollet

- Children's Minnesota

The Select ACO network is available in these Minnesota counties:

- Anoka

- Dakota

- Hennepin

- Ramsey

- Scott

- Washington

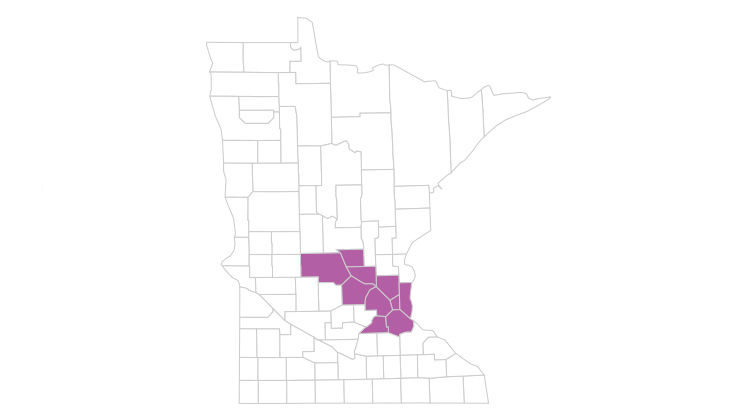

The Peak network

The Peak network features preferred care options in the Twin Cities and St. Cloud areas. It includes these providers (and more):

- HealthPartners and Park Nicollet

- CentraCare

- Entira Family Clinics

The Peak network is available in these Minnesota counties:

- Anoka

- Benton

- Carver

- Dakota

- Hennepin

- Ramsey

- Scott

- Sherburne

- Stearns

- Washington

- Wright

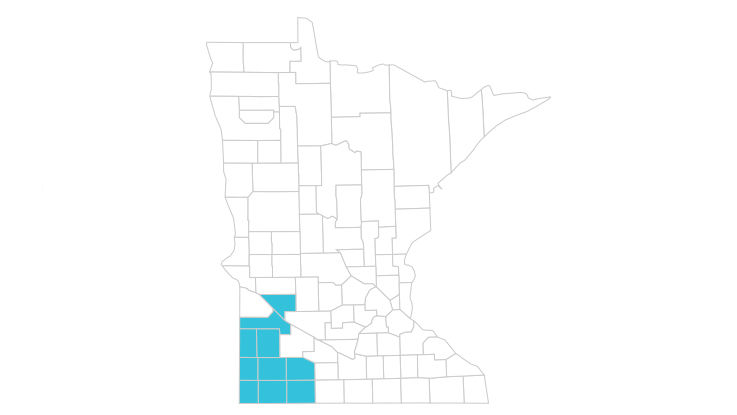

The Cornerstone network

The Cornerstone network delivers value and savings for people in southwest Minnesota. It includes these providers (and more):

- Access Health

- Avera Health

- CentraCare

The Cornerstone network is available in these Minnesota counties:

- Chippewa

- Cottonwood

- Jackson

- Lincoln

- Lyon

- Murray

- Nobles

- Pipestone

- Rock

- Yellow Medicine

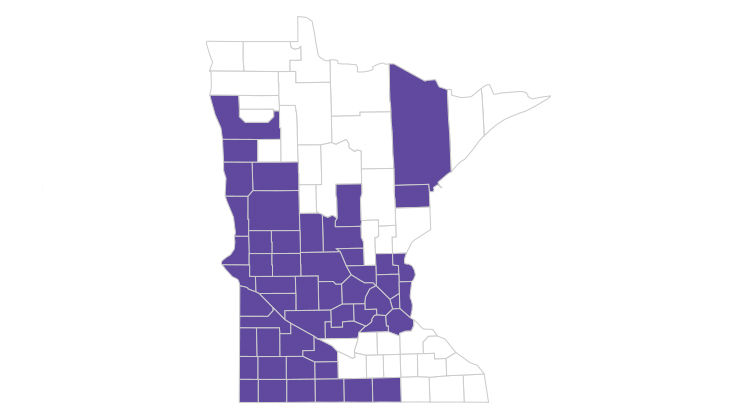

The Alpine network

The Alpine network offers broad access to nearly all providers in and around the Twin Cities and St. Cloud areas, and central and western Minnesota.

The Alpine network is available in these Minnesota counties:

- Anoka

- Becker

- Benton

- Big Stone

- Brown

- Carlton

- Carver

- Chippewa

- Chisago

- Clay

- Cottonwood

- Crow Wing

- Dakota

- Douglas

- Faribault

- Freeborn

- Grant

- Hennepin

- Isanti

- Jackson

- Kandiyohi

- Lac qui Parle

- Lincoln

- Lyon

- Martin

- McLeod

- Meeker

- Morrison

- Murray

- Nobles

- Norman

- Otter Tail

- Pipestone

- Polk

- Pope

- Ramsey

- Redwood

- Renville

- Rock

- St. Louis

- Scott

- Sherburne

- Sibley

- Stearns

- Stevens

- Swift

- Todd

- Traverse

- Washington

- Watonwan

- Wilkin

- Wright

- Yellow Medicine

2026 individual and family plan details

Want to know what kind of coverage you can expect? Take a look below at the coverage highlights of our self-purchased medical insurance plans. You’ll get a personalized monthly premium based on information you enter when you

Below are the plans we offer directly (you may find more HealthPartners options if you shop at

The chart lists what you pay:

| Plan name | Network options | Deductible | Office visits | Coinsurance | Out-of-pocket max |

|---|---|---|---|---|---|

| $8,400 HSA Bronze | $8,400 (individual) / $16,800 (family) | 0% after deductible | 0% after deductible | $8,400 (individual) / $16,800 (family) | |

| Easy Compare Bronze HSA | $7,500 (individual) / $15,000 (family) | $0 first four primary care visits, then $60 $140 specialty care | 50% after deductible | $9,700 (individual) / $19,400 (family) | |

| $6,800 Plus Bronze HSA | $6,800 (individual) / $13,600 (family) | $0 first three visits, then 30% after deductible | 30% after deductible | $10,600 (individual) / $21,200 (family) | |

| $4,600 Plus Silver | $4,600 (individual) / $9,200 (family) | $0 first three visits, then 20% after deductible | 20% after deductible | $9,200 (individual) / $18,400 (family) | |

| Easy Compare Silver | $4,500 (individual) / $9,000 (family) | $0 first four primary care visits, then $40 $100 specialty care | 30% after deductible | $9,200 (individual) / $18,400 (family) | |

| $3,800 HSA Silver | $3,800 (individual) / $7,600 (family) | 20% after deductible | 20% after deductible | $8,000 (individual) / $16,000 (family) | |

| $3,150 Plus Silver | $3,150 (individual) / $6,300 (family) | $0 first three visits, then 20% after deductible | 20% after deductible | $10,150 (individual) / $20,300 (family) | |

| $3,000 Silver | $3,000 (individual) / $6,000 (family) | $25 primary care $75 specialty care | 25% after deductible | $10,000 (individual) / $20,000 (family) | |

| $2,400 Gold | $2,400 (individual) / $4,800 (family) | $20 primary care $20 specialty care | 20% after deductible | $9,000 (individual) / $18,000 (family) | |

| Easy Compare Gold | $2,000 (individual) / $4,000 (family) | $0 first four primary care visits, then $30 $70 specialty care | 20% after deductible | $8,200 (individual) / $16,400 (family) | |

| $1,300 Gold | $1,300 (individual) / $2,600 (family) | $15 primary care $35 specialty care | 20% after deductible | $8,600 (individual) / $17,200 (family) |

For complete details,

All plans come with coverage for prescription medicines through our PreferredRx formulary (drug list). Specific coverage levels vary by plan – see your plan documents for more details. You can also review frequently asked questions (FAQs) about drug lists.

Extra perks that save time, money and peace of mind

No matter which plan you choose, you’ll get these additional perks (and much more) at no added cost:

- Award-winning support from our Minnesota-based

Member Services team - 100% coverage for

preventive care - 24/7 health support through

CareLine℠ - Access to

Virtuwell , our online clinic where you can get care anywhere

- Personalized

well-being and rewards programs - Worldwide emergency

coverage when traveling Member Assistance Program for help with life’s challengesSupport and resources for better health

You can also call us at 877-838-4949 or email us at IndividualSales@healthpartners.com.