Flexible and affordable dental insurance for seniors

We know how important it is to

We offer senior dental plans throughout Minnesota, western Wisconsin and northeastern Wisconsin. You can sign up at any time – no need to wait for an enrollment period.

First, choose one of our two dental networks

The right network for you depends on where you live, where you want to receive care and which dentist you’d like to see. Explore both our networks to see which would be best for you.

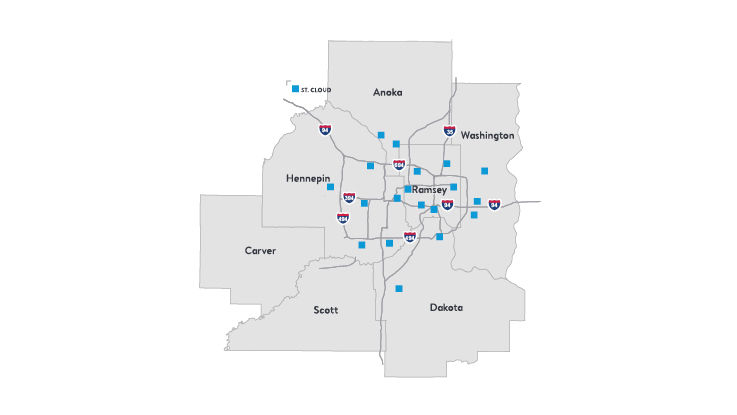

HealthPartners Dental Group (HPDG) network

The HPDG network features nearly 100 dentists and specialists providing reliable, top-notch care at clinics in and around the Twin Cities and St. Cloud.

Dental Open Access network

Available throughout Minnesota and Wisconsin, our Open Access network offers access to most dentists across both states – as well as 85,000 dentists nationwide.

Next, pick a plan that works for you

Once you’ve found a network you like, it’s time to pick a plan. We offer three types of dental plans, each with different levels of coverage depending on the kind of dental care you need. Check out the highlights below – for complete details, see our

Under 60? Our

Preventive Plus plan

If your teeth are healthy and you don’t think you’ll need a lot of dental work, consider choosing our Preventive Plus plan. This plan is ideal for people who expect just regular dental checkups, and care for the occasional cavity or denture repair.

Unless otherwise noted, the chart below lists what we pay when you see an in-network provider:

| Preventive Plus plan | Both networks |

|---|---|

| Your monthly premium | $32.49/month (HPDG network) or $39.73/month (Dental Open Access network) |

| Your deductible | $50/year |

| Diagnostic and preventive care | 100% before deductible (including three exams and cleanings per year) |

| Fillings | 80% after deductible |

| Simple extractions | 80% after deductible |

| Endodontics | Not covered |

| Periodontics | Non-surgical treatment: 80% after deductible Surgical treatment: Not covered |

| Major oral surgery | Not covered |

| Crowns | Not covered |

| Prosthetics, like bridges, dentures and implants | Bridge and denture repairs: 80% after deductible New bridges, dentures and implants: Not covered |

| Annual maximum (coverage limit) | $1,250/year |

Standard Comprehensive plan

If you think you need more than the basics or might need additional dental work like crowns, the Standard Comprehensive plan might be right for you. This plan is a great choice if you’re looking for coverage for a wide range of dental needs from preventive care to surgery, new dentures and more.

Unless otherwise noted, the chart below lists what we pay when you see an in-network provider:

| Standard Comprehensive plan | Both networks |

|---|---|

| Your monthly premium | $41.11/month (HPDG network) or $50.48/month (Dental Open Access network) |

| Your deductible | $50/year |

| Diagnostic and preventive care | 100% before deductible (including three exams and cleanings per year) |

| Fillings | 50% after deductible |

| Simple extractions | 50% after deductible |

| Endodontics | 50% after deductible |

| Periodontics | 50% after deductible |

| Major oral surgery | 50% after deductible |

| Crowns | 50% after deductible |

| Prosthetics, like bridges, dentures and implants | 50% after deductible |

| Annual maximum (coverage limit) | $1,000/year |

High Comprehensive plan

If you’re looking for a plan that has coverage for nearly everything dental, our High Comprehensive plan could be the right fit. This plan is a good option if you’ve had past dental work that needs ongoing care or you’ve noticed your dental needs changing.

Unless otherwise noted, the chart below lists what we pay when you see an in-network provider:

| High Comprehensive plan | Both networks |

|---|---|

| Your monthly premium | $46.85/month (HPDG network) or $57.63/month (Dental Open Access network) |

| Your deductible | $50/year |

| Diagnostic and preventive care | 100% before deductible (including three exams and cleanings per year) |

| Fillings | 80% after deductible |

| Simple extractions | 80% after deductible |

| Endodontics | 50% after deductible |

| Periodontics | 50% - 80% after deductible |

| Major oral surgery | 50% after deductible |

| Crowns | 50% after deductible |

| Prosthetics, like bridges, dentures and implants | Bridge and denture repairs: 80% after deductible New bridges, dentures and implants: 50% after deductible |

| Annual maximum (coverage limit) | $1,250/year |

Extra perks that come with all plans

In addition to great coverage and benefits, you’ll also have access to these additional perks:

- Coverage for dental care outside your network (at a reduced benefit)

- Additional benefits for members who are living with diabetes through

MouthWise Matters - Savings on eyewear, hearing aids, fitness equipment and more through Healthy Discounts℠

- Our HealthPartners mobile app, with 24/7 access to benefit details, claims, dental provider directories and much more

- Award-winning, locally based Member Services

- And more

We offer senior dental plans throughout Minnesota, western Wisconsin and northeastern Wisconsin. You can sign up at any time – no need to wait for an enrollment period.

Dental insurance 101

New to buying your own dental plan or dental insurance in general? We have the details on

Also need medical insurance?

In addition to our senior dental plans, we offer affordable medical plans designed with the benefits and coverage you need. With both your dental and medical plan through the same company, it’s easy to manage all your plans in one place. If you’re under 65,

Already have a HealthPartners Medicare plan?

You might already have dental benefits built into your Medicare plan. If you don’t, we offer supplemental dental coverage on select plans to help round out the Medicare benefits you’re looking for.